- Invest in 25 – 35 high quality positions at one time. High conviction and manageable

- Attractive long-term strategy of investing in high quality companies, at reasonable valuations

- Unchanged investment philosophy since 2008

- Team culture of debate and discussion to exploit diverse experience

- Current dislocation in the market offers a compelling entry point.

Past performance is not a guarantee of future returns

Past performance is not a guarantee of future returns

Where this strategy is acquired through a portfolio management service, additional charges may be applied by the portfolio manager.

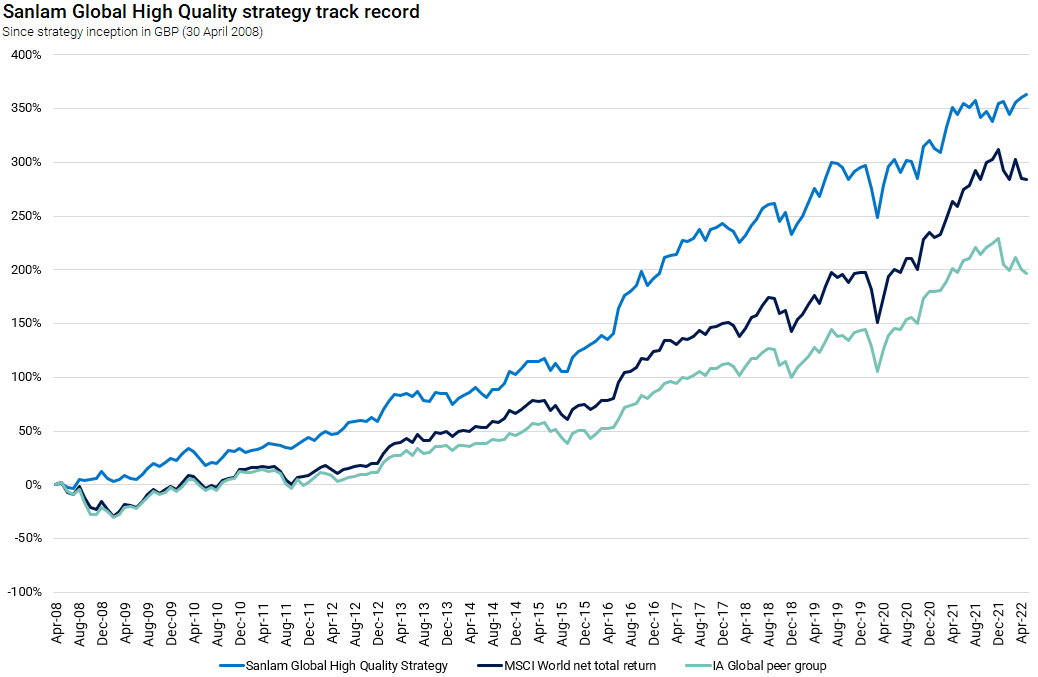

The comparison index is the MSCI World Index with net dividends reinvested. Sector is the IA Global

Period: 30.04.2008 to 31.5.2022 represents a composite of the manager’s global equity track record.

Past performance disclaimer. Performance from 30.04.2008 to 31.08.2012 is that of the ACPI segregated global equity mandate after all fees including transactions fees. From 31.08.2012 to 30.09.2012 is that of the MSCI World Index while the manager transitioned to the Sanlam group and from 30.09.2012 to 28.02.2014 is that of the Sanlam Private Wealth Global Equity Diversified Portfolio (net of all costs including transaction fees). 28.02.2014 is that of the Sanlam Global High Quality Fund, C share class, NAV based, total return (net of fees)

ACPI Investment Managers is an independently owned investment management partnership

Past performance should not be taken as an indicator of future performance.

Since investors may be liable to external fees, charges and taxes, the illustrated returns are not meant to provide a measure of actual return to investors. Class C shares are only available to those investors who have a separate investment management mandate with the Investment Manager.

Sources: Sanlam UK, MSCI, Morningstar GBP net returns