By Bénette Van Wyk CA (SA), Head Of Distribution, Catalyst Fund Managers

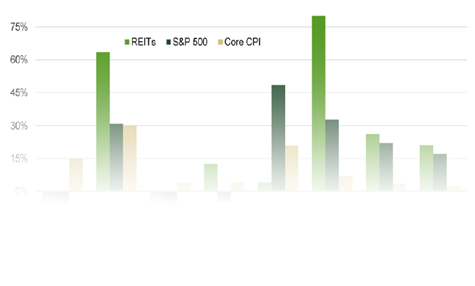

In 2021, worldwide consumer prices rose dramatically as the global economy navigated supply chain issues throughout its recovery from COVID-induced shutdowns. Annual inflation measured by the Consumer Price Index reached 7.0% in the US, the highest annual rate since 1981. While inflationary pressures are expected to continue well into 2022, historical analysis shows that REITs have provided protection against inflation and outperformed the broader stock market during periods of moderate and high inflation. Over the last 50 years, REITs outperformed the S&P 500 and CPI, in five of the eight periods of an inflationary spike (instances where CPI > 100 bps; please refer to the graph below).

REITs’ historical performance during periods of inflation

Total return during periods of rising CPI

Fund risks

The Fund has holdings which are denominated in currencies other than sterling and may be affected by movements in exchange rates. Consequently the value of an investment may rise or fall in line with the exchange rates.