Head of global equities, Pieter Fourie, has retained his FE Fundinfo Alpha Manager rating in 2025, being awarded this accolade for the 6th time.

The Alpha Manager Rating is a quantitative rating that distinguishes the top UK fund managers based on alpha generation and outperformance across their career history, allowing investors to instantly identify those managers who have consistently outperformed their peer group over time.

Only the top 10% of UK retail-facing managers receive this accolade, representing those managers who are the very best of the best in the industry.

Read more

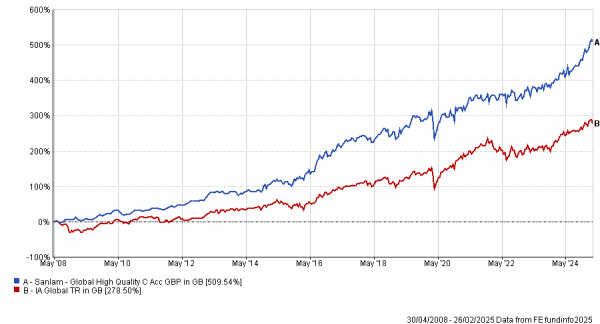

Pieter manages the Sanlam Global-High Quality Fund, launched in 2014, but has run the same strategy since 2008.

Cumulative performance

| Name |

1m |

3m |

6m |

1yr |

3yr |

5yr |

10yr |

| Sanlam Global High Quality C Acc GBP |

1.7 |

3.23 |

13.38 |

15.78 |

35.31 |

55.15 |

181.97 |

| IA Global |

-1.06 |

0.22 |

6.81 |

10.43 |

27.42 |

61.4 |

148.3 |

Annual discrete performance

| Name |

31/01/2024 to

31/01/2025 |

31/01/2023 to

31/01/2024 |

31/01/2022 to

31/01/2023 |

31/01/2021 to

31/01/2022 |

31/01/2020 to

31/01/2021 |

| Sanlam Global High Quality C Acc GBP |

21.07 |

6.94 |

3.13 |

10.48 |

4.03 |

| IA Global |

17.73 |

8.33 |

0.05 |

9.41 |

14.78 |

Past performance is not a guide to future performance.

Fund risks

The Fund may invest in companies based in emerging markets which may involve additional risks not typically associated with other more established markets such as increased risk of social, economic and political uncertainty. The Fund has holdings which are denominated in currencies other than sterling and may be affected by movements in exchange rates. Consequently the value of an investment may rise or fall in line with the exchange rates.

Important information

This communication is marketing material for professional investors only. The opinions are those of the named author(s) at the time of publication and are subject to change, without notice, at any time due to changes in market or economic conditions. Whilst care has been taken in compiling the content of this document, neither Sanlam nor any other person makes any guarantee, representation or warranty, express or implied as to its accuracy, completeness or fairness of the information and opinions contained in this document, which has been prepared in good faith, and to the fullest extent permissible under UK law.

This document is provided to give an indication of the investment and does not constitute an offer/invitation to sell or buy any securities in any fund managed by us nor a solicitation to purchase securities in any company or investment product. It does not form part of any contract for the sale or purchase of any investment. The information contained in this document is for guidance only and does not constitute financial advice.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued and approved by Sanlam Investments which is authorised and regulated by the Financial Conduct Authority. Sanlam Investments is the trading name for Sanlam Investments UK Limited (FRN 459237), having its registered office at 27 Clements Lane, London, EC4N 7AE.