Be flexible and focus on higher yielding assets

-

Use cash or other low duration stable value assets such as “cash-plus funds” ahead of government bonds for risk management and nominal capital value protection

-

A good proportion of traditional fixed income credit markets are “stuck in the middle” – they do not offer enough yield to protect against inflation but are still vulnerable to market shocks from either direction – higher government bond yields OR wider credit spreads

-

Focus on “yield for a given duration” - allocating capital to active managers in specialist higher-return segments such as Hybrid Capital, Emerging Markets and Private Credit.

Be skeptical of macro forecasting

As investors with over 30 years’ experience in fixed income markets, we have developed a healthy scepticism of the usefulness of macroeconomic forecasting. Not only is macro forecasting virtually impossible, profiting from being right about the market response to a given macro environment is a a separate challenge. The joint probability of forecasting “A” (macro environment) and then “B Given A” (market reaction to A) is very low for most investors.

Indeed, Consumer and Producer Price inflation in 2021 provided the perfect examples of macroeconomic outcomes which nobody predicted (rates of c.3% to 8% p.a.) combined with a reaction in the bond markets that nobody would have expected either, given those inflation rates (US, UK and EU government bond 10-year yields ending the year a long way below 2%.)

Understand the tactical and structural drivers of returns

Two drivers of meaningfully negative real rates on government bonds and a proportion of the credit markets can be thought of as “tactical” and “structural”.

Tactically, investors have kept government bonds with the view that the inflation is transitory (transitory having taken over from “unprecedented” as the word with most increased use).

Structurally, and far more important in our opinion, the regulatory framework for banks, insurance companies and pension funds has driven massive non-economic demand for government bonds –which are therefore by definition artificially expensive.

Favour cash over government bonds

So, one starting point for navigating fixed income in 2022 is to minimise holdings of government bonds in favour of cash. There is an argument that points to remaining invested in the asset class because if the structural demand is permanent there will always be some support for the market. But, given the very low real yields and very flat yield curves (meaning that yields do not increase much at all with maturity), cash is arguably safer as it does not have nominal value risk, only “real value” risk.

Beware market risk and mark to market losses

Secondly, in 2018-2021, many corporations have taken advantage of multi-generational low interest rates to issue bonds. Whilst corporate balance sheets are generally strong currently, in any downturn or protracted Covid-19-related economic slowdown, credit may become less easily available and credit spreads may increase.

Watch investment grade (IG) credit

Looking at the global credit markets, there are a lot of Single A and BBB bonds with yields below 3% with both duration and credit risk embedded. Risk here is less about permanent loss of capital through default, but more about market risk and mark-to-market losses which can take a long time to recover from the current low yield starting point.

If we look at the UK as a specific example, the iShares Core £ Corporate Bond UCITS ETF (SLXX LN) is a perfect case in point: This has a negative return of worse than -4 % in 2021; or more than -8% in real terms (past performance is not a guide to future returns). There is virtually no risk of default from credit names in the portfolio but the mix of low yield, credit market risk and long duration is toxic. The 2021 mark-to-market loss on this ETF will take more than two years to recoup at current yields (on a nominal basis only) and more like four years on a real basis. If yields continue to rise, this time to maintaining capital value in real terms could easily extend to 6-8 years. That is return-free risk.

The same pattern is repeated globally. According to Morningstar, the Bloomberg Global Aggregate Corporate USD index has produced a USD performance of -80 bps in in 2021.1 Bear in mind this outcome has occurred in an environment where other risk assets (equities) have performed strongly. After inflation, a small nominal loss guarantees large real losses for investors. Moreover, the starting level of yields and spreads today offers investors little or no protection in 2022 if inflation turns out to be something other than ‘transitory’.

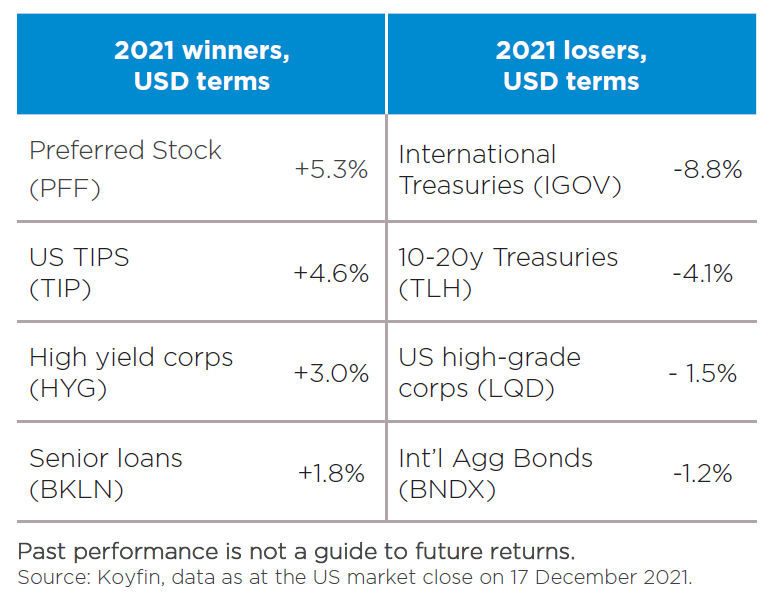

It’s also the case that investing in IG credit also means taking a view on risk-free rates due to the long duration of the asset class, which is perhaps a risky enterprise when a number of central banks (Fed included) would like to tighten rates from historically low levels to counter the threat from inflation. From a dollar investor’s perspective, we’ve highlighted some of the best and worst areas in 2021 YTD, using well-known and large ETFs as proxies.

What's best to do?

The current environment lends itself beautifully to detailed research, bottom-up investing and “brick by brick” portfolio construction. Every $ of capital allocated should be purposeful. This means picking up idiosyncratic, liquidity and complexity premia from individual securities where there is differentiation and clearly identified value-added features.

Ironically, the flip side of Quantitative Easing and central bank profligacy is that there is no longer any ‘free money’ in credit investing – certainly not after inflation. Generic long-only index and ETF fixed income products deliver the average return of the asset class and we can unambiguously state our view that in 2022 this average return from an 'average’ generic fixed income portfolio is not going to be attractive.

In short: go active, go focused and leave the unattractive generic middle of fixed income alone until it reprices to offer higher yields which properly compensate for risk.

1 Source: Morningstar, 1 Jan 2021 – 17 December 2021, in USD.

These views and opinions are his own and relate to how he manages his portfolios at Sanlam Investments. His comments should not be construed as recommendations or advice, but as an illustration of broader themes.

Important Information

Fund Risk

The Fund will invest in bonds and other debt instruments, this will be impacted by factors such as changes in interest rates and risk of default by the issuer. The Fund may engage in transactions in financial derivative instruments for hedging purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The Fund may invest in Contingent Convertible Securities (CoCos). The value of CoCos is unpredictable and will be influenced by many factors, without limitation (i) the creditworthiness of the issuers; (ii) economic, financial and political events that affect the issuer; (iii) general market conditions and available liquidity. The investor may not receive a return of principal if expected on a call date or indeed at any date.

This document is marketing material for professional investors only. Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

Issued and approved by Sanlam Investments which is authorised and regulated by the Financial Conduct Authority. Sanlam Investments is the trading name for our two Financial Conduct Authority (FCA) regulated entities: Sanlam Investments UK Limited (FRN 459237) and Sanlam Private Investments (UK) Ltd (FRN 122588), both having its registered office at 24 Monument Street, London, EC3R 8AJ. The UCITS Management Company has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

The opinions are those of the author at the time of publication and are subject to change, without notice, at any time due to changes in market or economic conditions. Whilst care has been taken in compiling the content of this document, neither Sanlam nor any other person makes any guarantee, representation or warranty, express or implied as to its accuracy, completeness or fairness of the information and opinions contained in this document, which has been prepared in good faith, and to the fullest extent permissible under UK law.

Some parts/sections of this document may have been compiled from external sources. Whilst these sources are believed to be reliable, the information has not been independently verified and is subject to material amendment, revision and updating, therefore no representation is made as to its accuracy or completeness. No reliance may be placed for any purpose whatsoever on the information, representations or opinions contained in this document nor shall it or any part of it form the basis of or act as an inducement to enter into any contract for any securities, and to the fullest extent permissible under UK law no liability is accepted or any such information, representations or opinions. The comments should not be construed as a recommendation of individual holdings or market sectors, but as an illustration of broader themes.

Statements in this document that reflect projections or expectations of future financial or economic performance of a strategy, or of markets in general, and statements of any Sanlam strategies’ plans and objectives for future operations are forward-looking statements. Actual results or events may differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statement. Important factors that could result in such differences, in addition to the other factors noted with forward-looking statements, include general economic conditions such as inflation, recession and interest rates, political or business conditions or in the tax or regulatory framework in the UK or other relevant jurisdictions, any of which could cause actual results to vary materially from the future results implied in such forward-looking statements. No assurance can be given as to the future results that will be achieved.

Sanlam makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any Sanlam Fund or Model Portfolio. Examples / Illustrations shown are only for the limited purpose of analysing general market, economic conditions or highlighting specific elements of the research process. FPR-0026209