The European Central Bank (ECB) has just announced its first interest rate cut in five years. Here I’ve highlighted two critical points regarding this development:

1. The Implications of Lower Rates and Real Yields

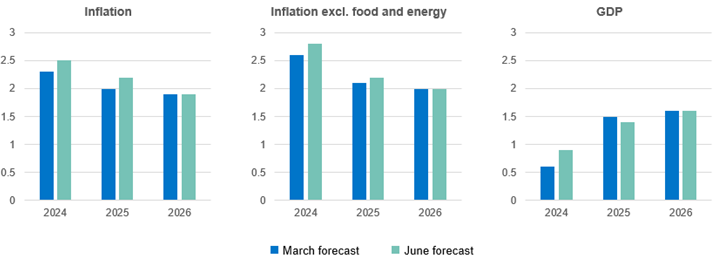

Interest rates have been reduced because current monetary policy is restrictive. Real yields, which measure how tight monetary policy is, provide a clear picture of this. For instance, the 2-year real yields in Germany stand at 1.5%. Real yield is the return an investor receives above the inflation rate. With the ECB forecasting inflation to be 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026, a 2-year German inflation-linked bond should yield approximately 3.7% in nominal terms. When this return is hedged back to GBP, as we typically do, the return could be around 5% in sterling terms, which represents excellent value.

2. Revised Inflation Forecasts

The ECB has revised its inflation forecasts higher for this year and the next. This upward revision indicates that inflation is expected to be more persistent than previously thought.

Source: ECB, 6 June 2024

A Constructive Environment for Inflation-Linked Bonds

When combining these two points, a compelling case emerges for inflation-linked bonds. If cash flows are expected to increase (due to higher inflation forecasts) and the discount rate used to calculate the present value of these cash flows decreases (due to the rate cut), it creates a favourable environment for inflation-linked bonds. This scenario implies that a bond's value should rise, making them an attractive investment.

Additional Considerations

Wage Growth: Wage growth is a crucial factor in the inflation outlook. Negotiated wages grew by 4.7% in the first quarter of 2024, reflecting a significant increase in workers' pay. This rise in wages contributes to higher disposable income, which can fuel consumer spending and, consequently, inflation. Higher wages often lead to increased demand for goods and services, pushing prices upward. The substantial wage growth we've observed is a sign of strong labour market conditions and suggests that inflationary pressures may persist, reinforcing the case for inflation-linked bonds.

The sustained wage increases also indicate that companies are willing to pay more to attract and retain employees, which could lead to cost-push inflation. In this context, inflation-linked bonds offer protection against the eroding purchasing power of fixed-income investments, making them an essential component of a diversified portfolio.

Market Dynamics: Although markets may initially react by pricing in fewer rate cuts, dubbing this a 'hawkish cut,' this sentiment can shift quickly. Each ECB meeting is live, and the governing council's decisions are data-dependent. The pace, magnitude, and terminal rate of future cuts will hinge on incoming data.

Given the uncertainties and the reliance on data for future policy decisions, it is prudent to consider some exposure to inflation-linked sovereign debt. This strategy provides a hedge against inflation and aligns with the expectations of higher future cash flows and lower discount rates.

Summary

In summary, the ECB's rate cut, combined with higher inflation forecasts and significant wage growth, creates a supportive environment for inflation-linked funds. This makes them a wise investment choice in the current economic climate, offering both protection against inflation and the potential for attractive returns.

Important information

This communication is marketing material for professional investors only. The opinions are those of the named author(s) at the time of publication and are subject to change, without notice, at any time due to changes in market or economic conditions. Whilst care has been taken in compiling the content of this document, neither Sanlam nor any other person makes any guarantee, representation or warranty, express or implied as to its accuracy, completeness or fairness of the information and opinions contained in this document, which has been prepared in good faith, and to the fullest extent permissible under UK law.

This document is provided to give an indication of the investment and does not constitute an offer/invitation to sell or buy any securities in any fund managed by us nor a solicitation to purchase securities in any company or investment product. It does not form part of any contract for the sale or purchase of any investment. The information contained in this document is for guidance only and does not constitute financial advice.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued and approved by Sanlam Investments which is authorised and regulated by the Financial Conduct Authority. Sanlam Investments is the trading name for Sanlam Investments UK Limited (FRN 459237), having its registered office at 27 Clements Lane, London, EC4N 7AE